Businesses in today’s globalised economy frequently conduct business beyond national borders and participate in international trade. They are confronted with a difficult monetary hurdle, international currency translation, due to their use of numerous currencies. This article goes deep into the nitty-gritty of “foreign currency translation” and the critical role that it plays in the development of worldwide financial planning.

Foreign Currency Translation: Learning How to Translate Between Different Currencies

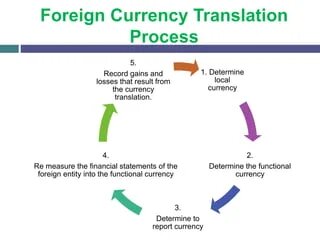

Foreign currency translation is the process of transforming financial statements from one currency into another. Multinational companies can’t accurately portray their financial performance on a global scale without making this conversion. Assets, liabilities, income, and expenses are all parts of the financial picture that need to be translated.

Foreign Currency Translation: The Value of a Precise Translation

To make educated business decisions, evaluate performance, and meet legal requirements, precise foreign currency translation is essential. Misinterpretation and financial danger can result from inaccurately translated financial statements.

Foreign Currency Translation: Difficulties arising from translating foreign currencies

Factors like fluctuating exchange rates, having many companies in different countries, and different accounting standards all add complexity to currency translation. For those who work in the financial sector, this complexity can lead to confusion.

Techniques for Converting Between Different Currencies

Foreign exchange can be calculated using either the current exchange rate or the history exchange rate. Each option is useful in different contexts and possesses unique benefits. For a complete translation plan, knowing when to employ each approach is crucial.

Definition of a Practical Currency

It is essential for precise translation to know a subsidiary’s functional currency. Converting financial dealings into the functional currency, which is the principal currency in the entity’s economic environment, saves time and effort.

Comparison of Past and Present Interest Rates

To translate a transaction using historical rates, you would use the exchange rate in effect at the time the transaction was made. On the other hand, the reporting date’s exchange rate is used for current rates. We discuss when each strategy works best.

Repercussions for the Balance Sheets

Foreign currency translation has a huge impact on financial statements. Understanding and analysing how it impacts the balance sheet, income statement, and equity section is essential.

Protective Measures

There are a number of essential precautions you can take to preserve your data and keep your online presence secure. Here are some important preventative steps to take:

Foreign Currency Translation: Powerful Passwords:

Make sure all of your passwords are secure and one of a kind. Mix in some numbers and symbols together with the letters. Keep personal details like your name and date of birth out of your passwords.

Foreign Currency Translation: Keyboard Shortcuts:

Consider using a password manager to securely store and generate complicated passwords. This can help you manage many accounts properly.

Commonly known as “2FA,” or “two-factor authentication,”

When two-factor authentication is an option, use it. A second verification step, such a code texted to your phone, is needed in addition to your password, increasing the safety of the system.

Foreign Currency Translation: Constantly Updating:

Update your OS, software, and programmes regularly. Security patches, designed to close exploitable holes, are a common component of updates.

Internet Protection with Virus Scanners:

Firewall and anti-virus software should be installed and kept up to date on all devices. Malware and other security concerns can be identified and avoided with the aid of these instruments.

Foreign Currency Translation: Private wireless LANs:

Password-protecting and encrypting your home Wi-Fi network is essential. Never use the router’s factory-default password.

Information Security:

Protect private information by encrypting it. This makes it so that even if someone were to intercept your data, it would be illegible.

Save Your Files:

Backup your data on a regular basis, whether to an external drive or the cloud. You can get your data back in the event of a hack or data loss.

Watch out for Phishing:

Do not open attachments from unknown senders. Do not open files or click on links from suspicious senders. People are often duped into giving up personal information in phishing assaults.

Internet Security:

Maintain a browser that is up to date and safe. Stay away from websites that might try to trick you into downloading software or clicking on pop-ups.

Security in Social Media:

Check your social media profiles’ privacy settings and modify them as necessary.

The Reduction of Data:

Don’t be too secretive; just give out the bare minimum of information. Never reveal any more information than is absolutely necessary when signing up for a service or making an online purchase.

Learn Something:

Learn as much as you can about current cyberthreats and how to protect yourself from them. Be sure to update your knowledge of potential dangers and safety precautions on a regular basis.

Mobile Device Security:

Protect your mobile devices by using passcodes, a biometric scanner, or both.

Scanning Schedule:

Make regular scans with your trusted security software to ensure that your gadgets are virus-free.

Taking these precautions will greatly lessen the likelihood that your data will be stolen or that you will be the target of a cyberattack. Maintaining a secure digital space requires a constant state of vigilance and knowledge.

Research Examples: Global Conglomerates

We examine real-world case studies of multi-national firms that have handled currency translation with success, highlighting their approaches and lessons gained.

Compliance with Regulations

Regulatory organisations apply rules and standards on foreign currency translation to maintain uniformity and comparability in financial reporting. We go over the most important rules and regulations that businesses must follow.

Managing Risk in a Foreign Language

Foreign currency translation necessitates an awareness of and strategy for dealing with currency risk. We investigate methods of managing risk to lessen the effect of exchange rate changes.

Conversion of Technologies and Money

Foreign currency translation has been transformed by technological advancements. We talk about how software and machines can help speed up the translation procedure.

The Prospects for Global Currency Conversion

Methods for converting currencies may change as the world economy develops. We make educated guesses on what the future holds for our industry.

Conclusion

To sum up, understanding how to translate foreign currency is an important ability for businesses to have in today’s global market. In order to make educated judgements, maintain regulatory compliance, and competently manage currency risk, accurate and transparent translation of financial data is essential.

An advantage in the global market can be gained by knowing the ins and outs of foreign currency translation and its effect on financial statements. Businesses can protect their finances by identifying the functioning currency, employing the proper translation process, and applying hedging methods.

Successful currency translation is feasible, as shown by real-world case studies, and can yield substantial benefits. Financial reporting is more reliable and transparent if it is consistent with regulatory regulations.

Foreign currency translation is anticipated to benefit in the future from technological innovations that streamline the process and increase precision. Adapting to these changes is necessary to maintain competitiveness in the global economy.

Understanding how to translate between different currencies is becoming increasingly important for organisations as they expand internationally. It’s essential for succeeding in the global economy and making the most of the numerous opportunities it presents.

To investigate this further and acquire deeper insights into foreign currency translation, consider seeking expert help and staying updated on the newest trends in international finance.

FAQs

Why does it matter to know which currency is being used?

Establishing the functional currency streamlines and verifies the process of translating between different currencies.

How can changes in exchange rates influence financial reports?

The stated value of assets, obligations, and income can be impacted by movements in exchange rates, which in turn can alter financial statements.

I was wondering if translating currencies posed any legal requirements.

Yes, norms and standards are imposed by regulatory authorities to ensure financial reports are consistent and comparable.

Can you name some common hedging strategies for dealing with foreign exchange risk?

Standard hedging techniques consist of natural hedges, options, and forward contracts.

How might digital tools facilitate the translation of foreign currencies?

The translation process can be automated with the use of specialised software, which can greatly increase productivity and precision.

For Further Information Visit:https://www.fabulaes.com/